USD/CAD Price Analysis: Bears catching a breather around 2.5-year low

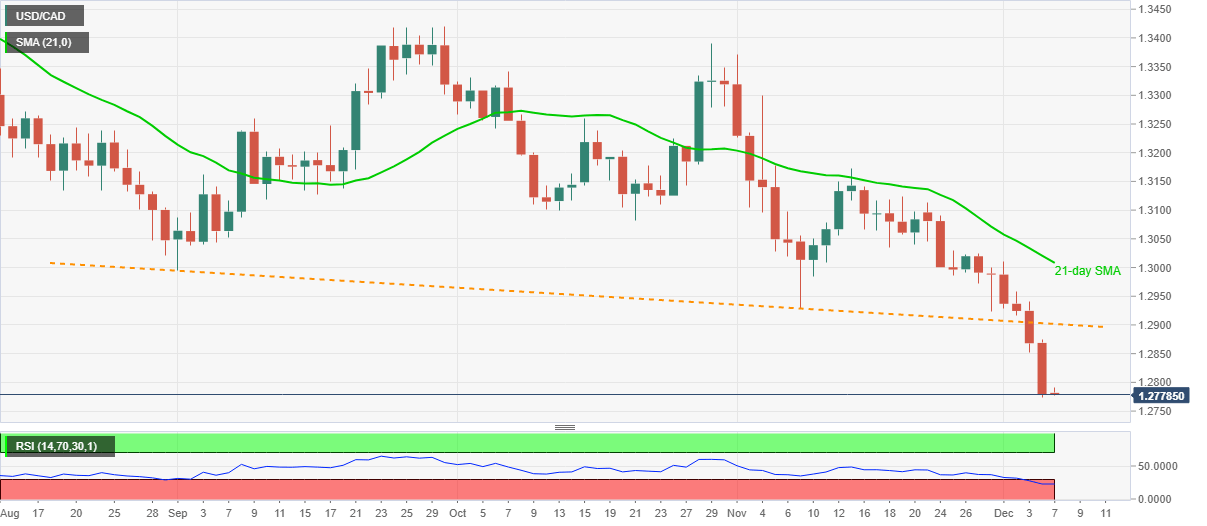

- USD/CAD stays depressed in a choppy range below 1.2800.

- Oversold RSI conditions favor pullback from late-May 2018 low.

- Three-month-old falling trend line, previous support, guard immediate upside.

USD/CAD seesaws between 1.2790 and 1.2776, currently testing lows, during the initial Asian session on Monday. The loonie pair slumped to the lowest since May 22, 2018 low on Friday. However, oversold RSI conditions seem to restrict the quote’s further downside.

As a result, the odds of the pair’s corrective recovery towards the previous support line from September 01, at 1.2900 now, can’t be ruled out.

Though, the 1.3000 threshold and the 21-day SMA near 1.3010 can challenge any further recovery moves.

Meanwhile, a downside break below the latest low of 1.2774 will eye for May 2018 bottom close to 1.2730. If at all the USD/CAD bears keep the reins past-1.2730, the 1.2700 round-figures and multiple highs marked between April 11 and 16 of 2018, near 1.2625/20, will be in the spotlight.

Overall, the bears are likely to keep the throne unless prices successfully break the 1.3000 round-figure.

USD/CAD daily chart

Trend: Bearish