USD/IDR technical analysis: Buyers ignore Indonesian holidays, clear near-term resistance confluence

- Break of near-term resistance-joint indicates pullback amid the latest downturn.

- 14,455/65 seems tough upside resistance to watch.

Despite Eid Al Fitr holidays at Indonesia, the USD/IDR pair manages to cross near-term resistance confluence as it takes the bids near 14,287 during early Thursday.

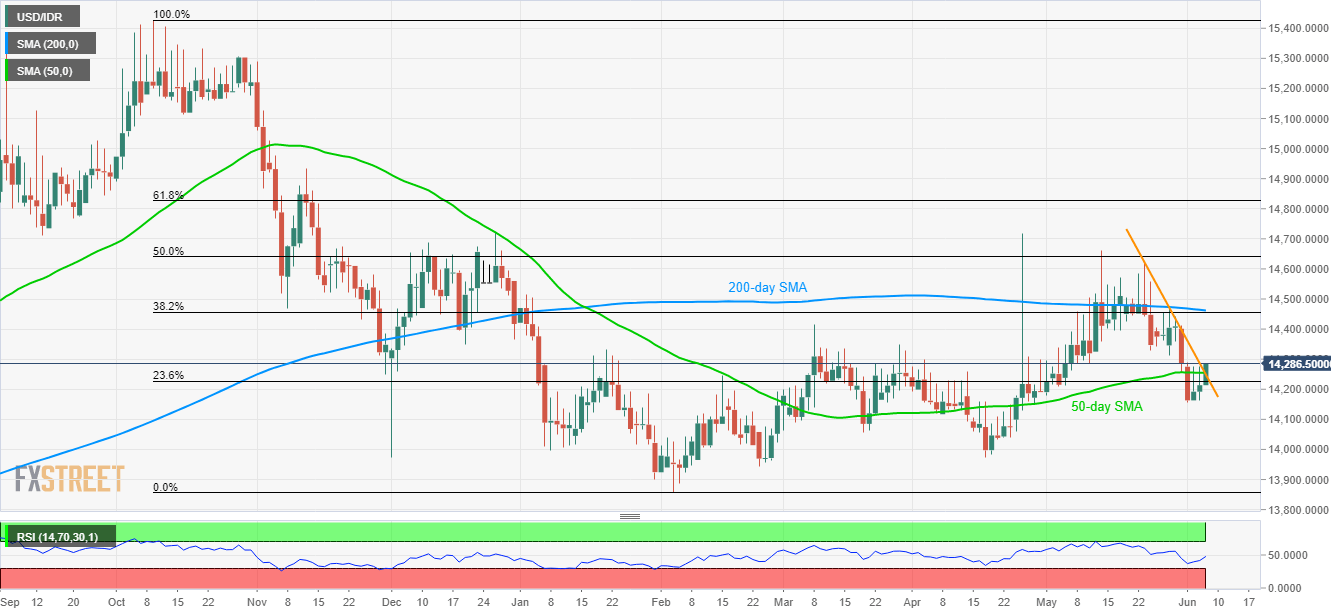

Having cleared a joint of the 50-day simple moving average (SMA) and a fortnight old descending trend-line, the quote now aims for 14,350 number to the north.

However, 14,455/65 area comprising 200-day SMA and 38.2% Fibonacci retracement of its October 2018 to February 2019 decline can question bulls past-14,350.

On the contrary, pair’s downside break of current month lows near 14,157 highlights 14,055 and 14,000 round-figure as adjacent supports whereas April bottom surrounding 13,975 could play its role afterward.

Additionally, 13,940 and the year 2019 low near 13,858 could entertain bears during the quote’s declines under 13,975.

USD/IDR daily chart

Trend: Pullback expected