Gold Technical Analysis: Once again fails near 1-week old trading range hurdle

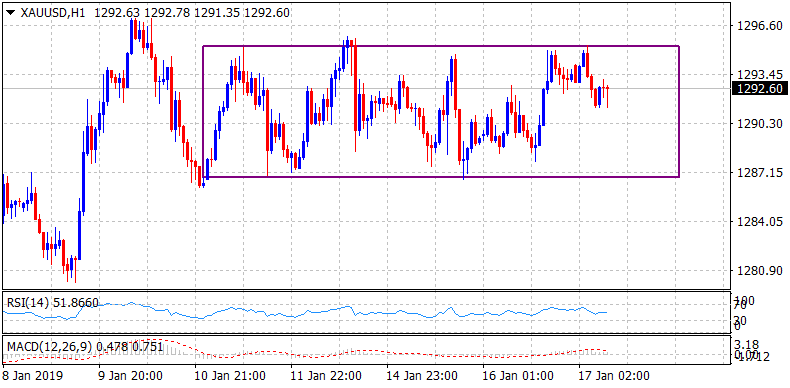

• The precious metal struggled to build on the overnight positive momentum and was again seen retreating from the top end of a near one-week-old trading range.

• The recent price-action constituted towards the formation of a rectangle, usually seen as continuation pattern but sometimes mark significant trend tops/bottoms.

• The fact that bulls have repeatedly failed ahead of the $1300 psychological mark points to increased selling pressure/long-unwinding pressure at higher levels.

• However, bullish technical indicators on hourly/daily charts remain supportive of persistent dip-buying interest at the lower end of the recent trading band.

• Hence, traders are likely to wait for a convincing breakthrough the mentioned range before positioning aggressively for the commodity's next leg of a directional move.

Gold 1-hourly chart

XAU/USD

Overview:

Today Last Price: 1292.61

Today Daily change: -49 pips

Today Daily change %: -0.0379%

Today Daily Open: 1293.1

Trends:

Previous Daily SMA20: 1281.08

Previous Daily SMA50: 1249.37

Previous Daily SMA100: 1231.38

Previous Daily SMA200: 1228.91

Levels:

Previous Daily High: 1295.25

Previous Daily Low: 1276.2

Previous Weekly High: 1297.15

Previous Weekly Low: 1279.35

Previous Monthly High: 1284.7

Previous Monthly Low: 1221.39

Previous Daily Fibonacci 38.2%: 1287.97

Previous Daily Fibonacci 61.8%: 1283.48

Previous Daily Pivot Point S1: 1281.12

Previous Daily Pivot Point S2: 1269.14

Previous Daily Pivot Point S3: 1262.07

Previous Daily Pivot Point R1: 1300.17

Previous Daily Pivot Point R2: 1307.23

Previous Daily Pivot Point R3: 1319.22