Back

13 Jul 2018

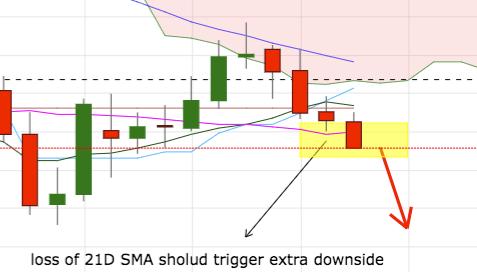

EUR/USD Technical Analysis: a breakdown of 21-day SMA at 1.1650 could open the door to 1.1508. Spot needs to regain 1.1790 to allow for extra gains.

- Spot continues to retreat from Monday’s tops in the 1.1790/95 band and currently tests weekly lows in the 1.1630 region. The bearish mood is reinforced by prices trading below the Ichimoku cloud.

- The rejection from the 200-hour SMA in the 1.1700 neighbourhood (Thursday top) also acts as a catalyst for further downside.

- The loss of the 21-day SMA in the key area around 1.1650 (coincident with a retracement of the 1.1508-1.1791 move) has now opened the door for a deeper retracement that should put the 1.1500 area back on the radar.

- The daily RSI (14) is pointing south around 44.0, leaving plenty of room for further decline.

EUR/USD daily chart

Daily high: 1.1675

Daily low: 1.1627

Support Levels

S1: 1.1648

S2: 1.1625

S3: 1.1601

Resistance Levels

R1: 1.1695

R2: 1.1719

R3: 1.1742