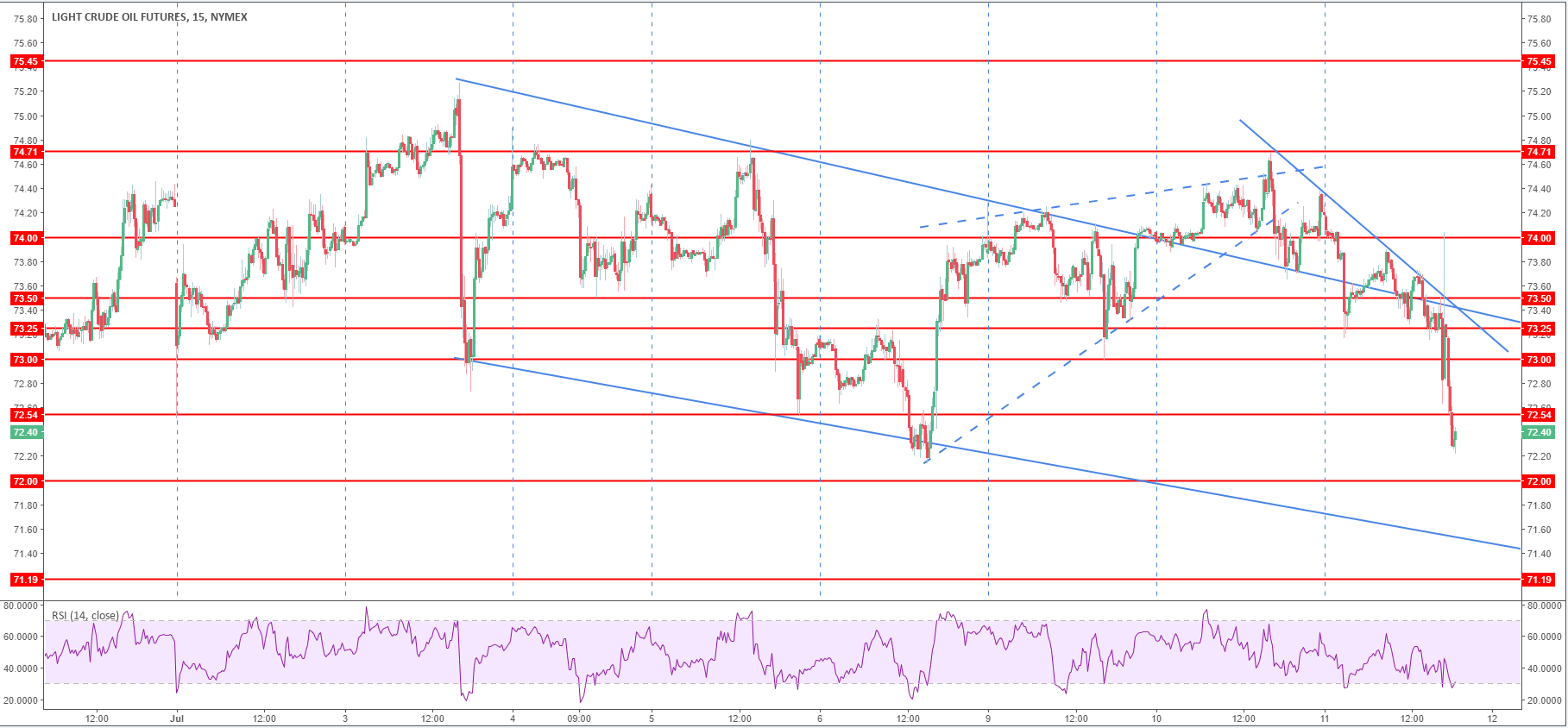

Crude Oil WTI Technical Analysis: Bears take over, WTI en route to worst daily close since mid-June

- Crude oil finally broke below $73.00 a barrel after two days of consolidation.

- Crude oil is currently en route to test last week’s low at 72.25. A breakout below the level can lead to an exacerbation of the bear move. However, bears will need to overcome the 72.00 figure and the lower trendline which can both act as support in the near-term.

- Pullbacks can be expected and immediate resistances are seen near 72.53 July 5 low and the 73.00 figure.

Crude oil WTI 15-minute chart

Spot rate: 72.41

Relative change: -2.19%

High: 74.24

Low: 72.12

Trend: Bearish

Resistance 1: 72.53 July 5 low

Resistance 2: 73.00 figure

Resistance 3: 73.25 November 14, 2014 low

Resistance 4: 74.00 figure

Resistance 5: 74.71 November 17, 2014 low

Resistance 6: 75.27 current 2018 high

Resistance 7: 75.45 November 24, 2014 low

Resistance 8: 76.00 figure

Support 1: 72.83 June 27 swing high

Support 2: 72.25 last week’s low

Support 3: 71.19 May 23 low

Support 4: 70.53 May 24 low