EUR/USD: Downside exposed as ECB balance sheet hit new record high

- Fed-ECB central bank divergence to hurt the EUR.

- Below-forecast German and Eurozone CPIs will likely add to the bearish sentiment around the EUR.

The euro dropped to 1.1816 - the lowest level since Dec. 19 as the as the yield on the 10-year Treasury notes rose to 3.09 percent, the highest since 2011 after upbeat US retail sales figure boosted expectations of faster Fed rate hikes.

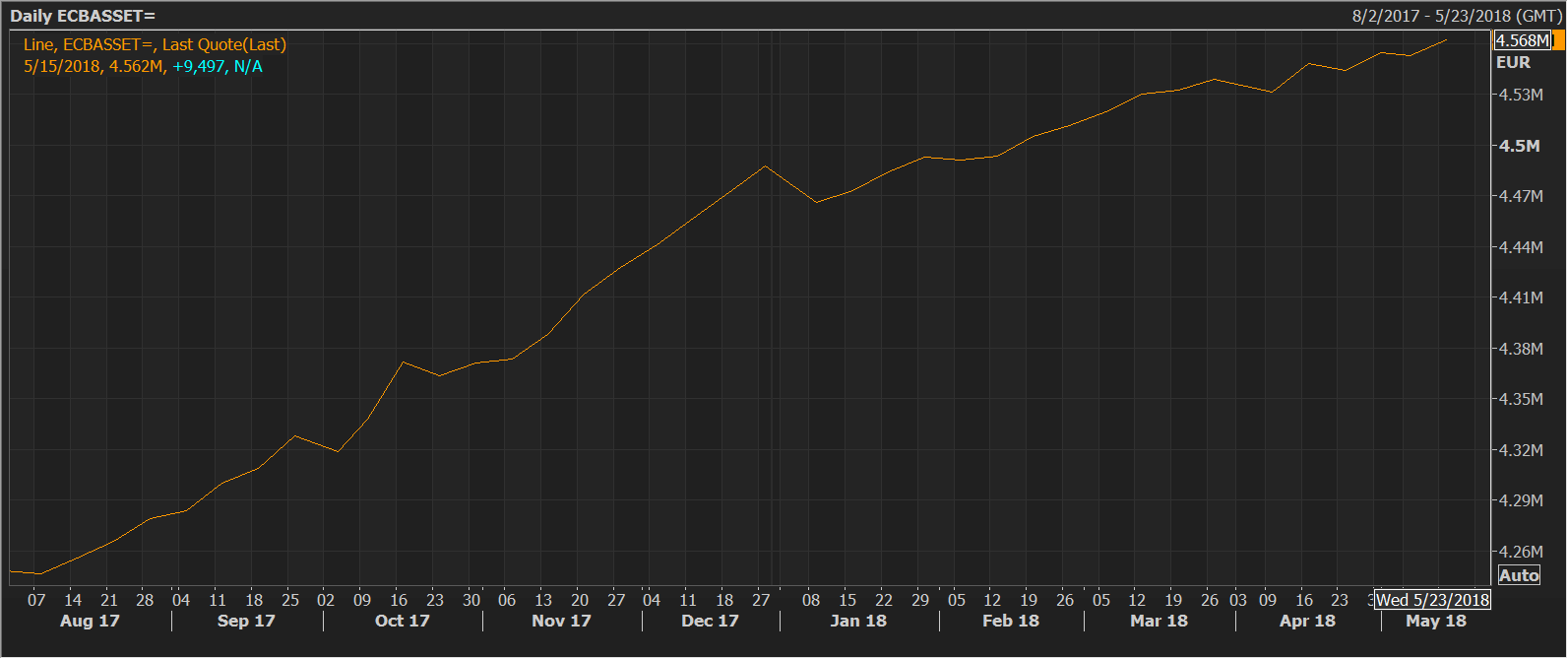

The common currency could continue losing altitude in the near future as the ECB and the Fed continue to move in opposite directions. The ECB balance sheet has expanded to a new lifetime high - the total assets rose by another €9.5bn to €4,562.1bn. On the other hand, the Fed is tapering its balance sheet.

Hence, the US-German yield differential could continue to widen further in the USD-positive manner.

As for today, the focus is on the German and Eurozone April consumer price index (CPI) release. A below-forecast reading will only make matters worse for the EUR bulls.

EUR/USD Technical Outlook

The bias remains bearish as indicated by the descending 5-day moving average (MA) and the 10-day MA. However, the 14-day relative strength index (RSI) shows oversold conditions. So, a minor corrective rally could be on the cards.

Support: 1.1790 (76.4% Fib R of Nov-Feb rally), 1.1718 (Dec. 12 low), 1.1669 (June 10 low).

Resistance: 1.1890 (5-day MA), 1.1903 (10-day MA), 1.1961 (Nov. 27 high).

ECB balance sheet size (Source: Reuters)