USD/JPY jumps above 111.00 as the USD rises across the board

A stronger US dollar in the market, higher equity prices, and rising US bond yields pushed USD/JPY to the upside. The pair broke above 111.00 and jumped to 111.35, reaching a 2-day high, more than a hundred pips above the lows.

A sharp reversal

First, during the Asian session and then after the release of the US employment report, the USD/JPY pair fell to test the 110.10 support area. Both times it failed to break lower and rebounded.

During the first half of the American session, the rebound was modest, with price remaining below 110.80. Recently, the greenback gained momentum and the pair started to rally. It peaked at 111.35 and currently remains near the highs, holding a strong bullish tone, near the end of the week.

So far, there is no clear catalyst for the move in the USD. Earlier Fed’s Dudley spoke regarding the scenarios for the future of monetary policy.

Fed's Dudley: Rates will be primary policy tool

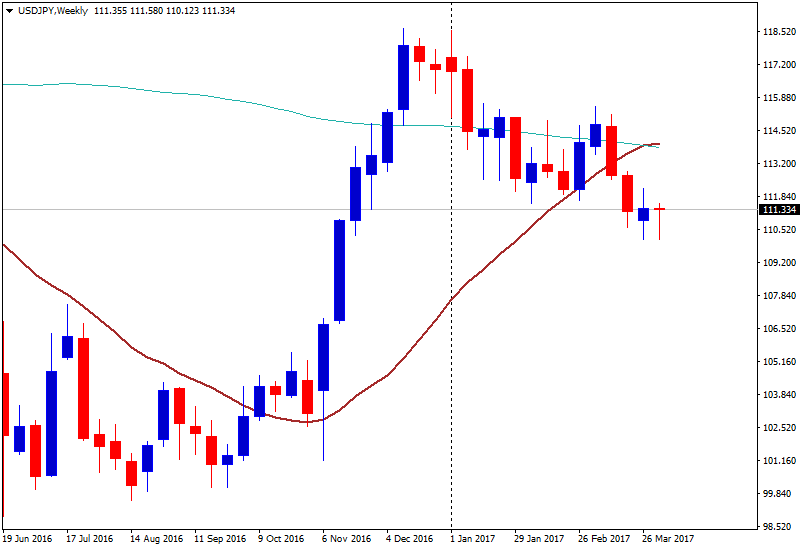

USD/JPY Wider perspective

The pair is trading practically at the same level it closed last week. On the weekly chart is making a Doji formation, pointing that there is no clear trend in the short-term and that the consolidation could continue.

A recovery above 112.00 could clear the way to more gains to the US dollar, but only on top of 114.00/40 (20-week moving average/downtrend line), it would remove the bearish bias.

On the downside, if the pair finally breaks below 110.00 it could resume the decline, in line with the current dominant trend.